Employee Credit Checks are becoming more common for employers and their pre-employment screening process; particularly with the recent increase in employee fraud in recent times.

Finance and law firms are legally obliged to run employee credit checks. However, companies from other sectors are starting to use the checks. These include education, healthcare, transport, logistics, to name a few.

In addition, companies who are hiring individuals who will be handling financial assets and data are starting to use these checks.

In this employer’s guide, we discuss what employee credit checks are, why employers should use them, and what tools can help.

What is an Employee Credit Check?

An employee credit check (also known as a pre-employment credit check) is a type of background that helps employers understand the financial situation of a candidate.

What comes up on an employee credit check?

An employee credit check will check public and private databases for the following information:

- County Court Judgements (CCJs)

- Bankruptcies

- Individual Voluntary Arrangement (IVA) / Bankruptcy

- Correction orders / disputes

- Electoral roll registration history (to confirm their current address)

- Decrees

- Administration orders

Why should employers perform an Employee Credit Check?

An employee credit check serves two functions.

Firstly, it acts a fraud prevention measure. Many employers believe that a candidate with debts, CCJs, and a generally poor financial history are more likely to commit fraud. Of course, candidates with good credit can still go onto commit fraud in some form. Therefore, it is recommended that employers couple a credit check with a DBS check (criminal record check); thus, enabling them to make a more informed hiring decision.

Secondly, it helps employers understand whether a candidate is suitable for a role where they have access to financial assets and data. Employers who use the checks believe that if a candidate has poor credit, they will be unsuitable when it comes to handling finances.

Can you deny a candidate employment if they have bad credit?

Yes. If you feel a candidate’s financial situation could impact their ability to perform well in the role, you can deny them employment.

How can I get my candidates to do an Employee Credit Check?

There are two ways you can get a candidate to do a credit check.

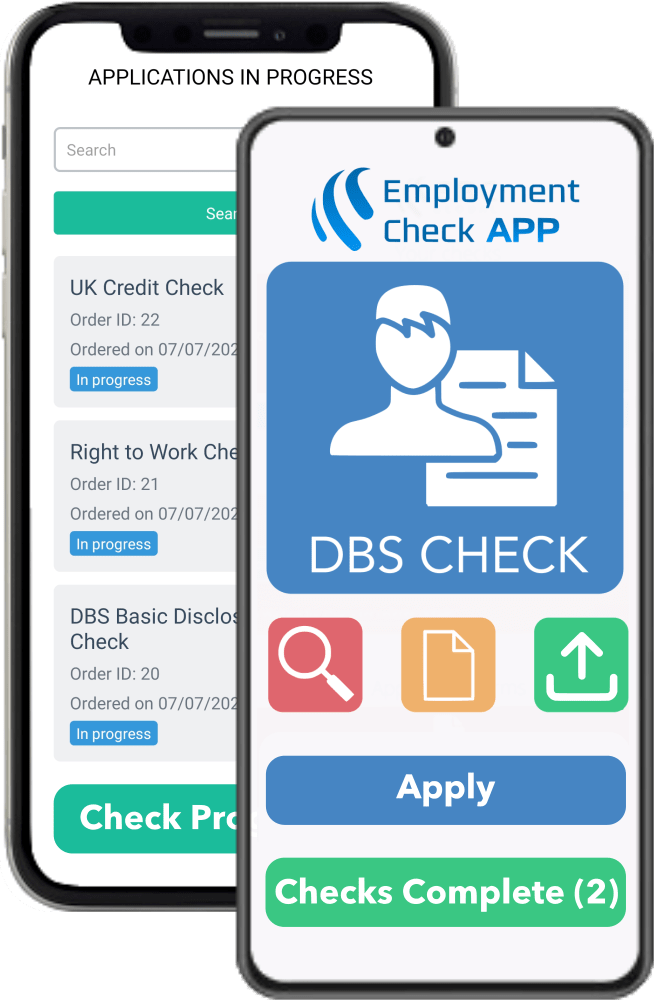

Firstly, they can use Employment Check App. This app allows candidates to complete an employee credit check (alongside other checks such as DBS, right to work, and more) and send results directly to employers. 95% of digital results are delivered instantly, allowing employers to save time (and other resources) when it comes to the pre-employment screening stage. You can find out more about Employment Check App here.

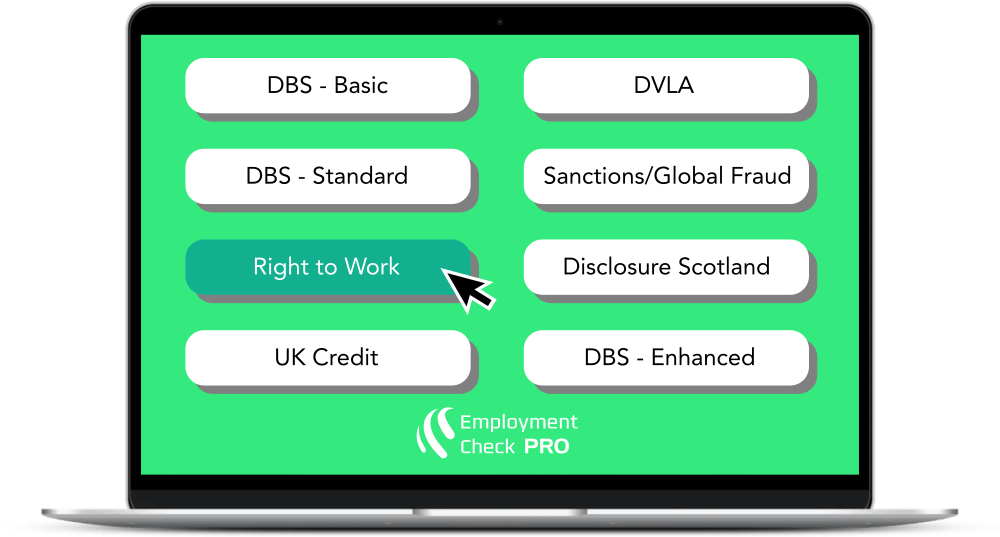

Secondly, there is Employment Check Pro. For employers who screen and onboard a large quantity of candidates at a time, Employment Check Pro provides a single solution, not only for credit checks, but all other employment background checks. Pro supports all legal requirements and employment checks for candidates across all sectors. It also helps employers reduce the time associated with the new hire process by approx. 70%.

You can find out more about Employment Check Pro here.

Further Reading

Background Checks – Ten key checks employers must make

HR Risks – 8 Background Screening Process Mistakes To Avoid